STIMULUS FOR INDIVIDUALS

Direct Stimulus Payments

DETAILS:

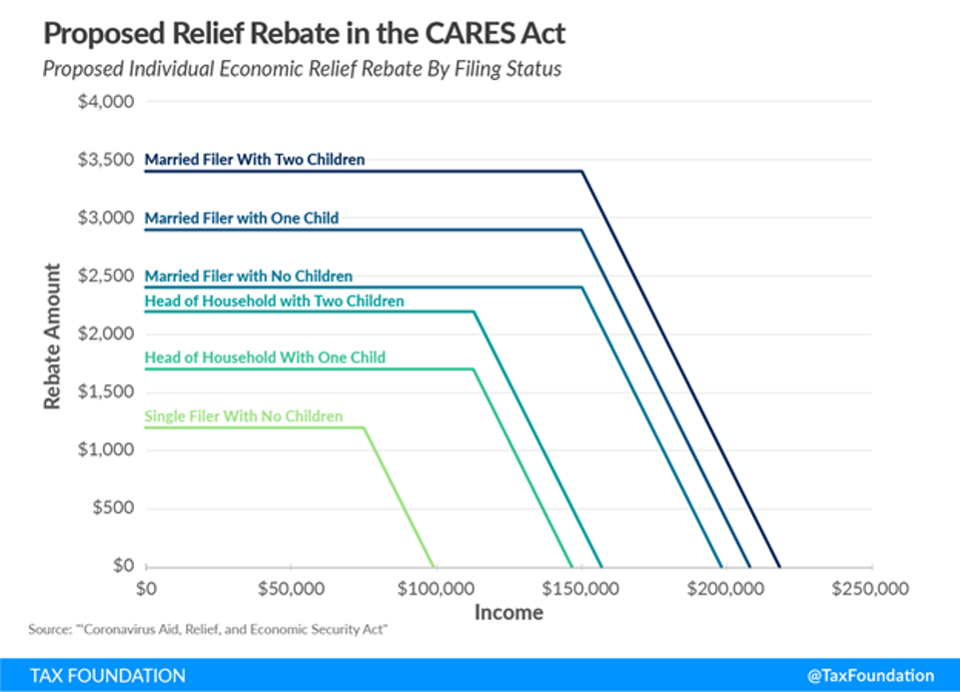

Individuals who pay taxes will receive a one-time payment of up to $1,200 with married couples receiving up to $2,400. You may also receive up to $500 per child age sixteen or under.

WHO IT APPLIES TO:

US Citizens who pay taxes. Phase out rules apply based upon 2019 income tax return (if filed, otherwise 2018). Individuals begin phaseout if earning $75,000 or more. Married couples begin phaseout if earning $150,000 or more. Expected payment amounts are outlined in the chart from the Tax Foundation below:

Individuals who pay taxes will receive a one-time payment of up to $1,200 with married couples receiving up to $2,400. You may also receive up to $500 per child age sixteen or under.

WHO IT APPLIES TO:

US Citizens who pay taxes. Phase out rules apply based upon 2019 income tax return (if filed, otherwise 2018). Individuals begin phaseout if earning $75,000 or more. Married couples begin phaseout if earning $150,000 or more. Expected payment amounts are outlined in the chart from the Tax Foundation below:

HOW DO I GET IT?

No action is necessary. If the IRS already has your bank account information from your 2018 or 2019 tax return, they will direct deposit any amount you qualify for. If the IRS does not have your bank account information, it is expected that you will receive a check in the mail.

No action is necessary. If the IRS already has your bank account information from your 2018 or 2019 tax return, they will direct deposit any amount you qualify for. If the IRS does not have your bank account information, it is expected that you will receive a check in the mail.

Use of Retirement Funds

DETAILS:

This is a multi-faceted stimulus component.

First, the legislation waives the 10% early withdrawal penalty for distributions up to $100,000 for coronavirus-related purposes, retroactive to January 1, 2020. Withdrawals are still taxed, but taxes are spread over three years or the taxpayer has the three-year period to roll it back over.

Second, the legislation increases the limit of 401(k) loans from $50,000 to $100,000.

Third, Required Minimum Distributions (RMDs) from IRAs and 401(k) plans at age 72 are suspended.

WHO IT APPLIES TO:

Anyone with a qualifying retirement account

HOW DO I GET IT?

You can withdraw funds (or avoid withdrawing funds in the case of RMDs) directly from your retirement account immediately. Waivers that are enabled by the stimulus package will be addressed on your 2020 tax returns.

This is a multi-faceted stimulus component.

First, the legislation waives the 10% early withdrawal penalty for distributions up to $100,000 for coronavirus-related purposes, retroactive to January 1, 2020. Withdrawals are still taxed, but taxes are spread over three years or the taxpayer has the three-year period to roll it back over.

Second, the legislation increases the limit of 401(k) loans from $50,000 to $100,000.

Third, Required Minimum Distributions (RMDs) from IRAs and 401(k) plans at age 72 are suspended.

WHO IT APPLIES TO:

Anyone with a qualifying retirement account

HOW DO I GET IT?

You can withdraw funds (or avoid withdrawing funds in the case of RMDs) directly from your retirement account immediately. Waivers that are enabled by the stimulus package will be addressed on your 2020 tax returns.

Charitable Giving

DETAILS:

Typically, you can only deduct charitable donations if you itemize deductions. As part of the legislation, the IRS is allowing an “above the line” deduction for charitable cash donations of up to $300 for those claiming the standard deduction on their 2020 tax return. This “above the line” deduction does not apply to taxpayers who itemize deductions on their 2020 return.

WHO IT APPLIES TO:

Taxpayers claiming the standard deduction on their 2020 tax return.

HOW DO I GET IT?

Make a cash donation to a charity in excess of $300 and file your 2020 tax return using the standard deduction.

Typically, you can only deduct charitable donations if you itemize deductions. As part of the legislation, the IRS is allowing an “above the line” deduction for charitable cash donations of up to $300 for those claiming the standard deduction on their 2020 tax return. This “above the line” deduction does not apply to taxpayers who itemize deductions on their 2020 return.

WHO IT APPLIES TO:

Taxpayers claiming the standard deduction on their 2020 tax return.

HOW DO I GET IT?

Make a cash donation to a charity in excess of $300 and file your 2020 tax return using the standard deduction.

Unemployment Insurance Compensation

DETAILS:

The legislation provides $250 billion for an extended unemployment insurance program which expands eligibility and offers workers an additional $600 per week for up to four months. This is in addition to what state programs pay. It also extends standard UI benefits through December 31, 2020 for eligible workers.

WHO IT APPLIES TO:

Recently laid-off employees, employees with reduced pay, self-employed, independent contractors, and gig economy workers. Please note that this is the first time that the latter three are eligible under a federal program. If you or your friends & family fall under any of these categories, it is highly recommended that you investigate applying.

HOW DO I GET IT?

The federal assistance will be administered by the state UI programs. Therefore, you must apply with your state UI program. Please note that there have been record unemployment claims filed recently. Therefore, it is advised that you file quickly if you are eligible in order to avoid delays.

The legislation provides $250 billion for an extended unemployment insurance program which expands eligibility and offers workers an additional $600 per week for up to four months. This is in addition to what state programs pay. It also extends standard UI benefits through December 31, 2020 for eligible workers.

WHO IT APPLIES TO:

Recently laid-off employees, employees with reduced pay, self-employed, independent contractors, and gig economy workers. Please note that this is the first time that the latter three are eligible under a federal program. If you or your friends & family fall under any of these categories, it is highly recommended that you investigate applying.

HOW DO I GET IT?

The federal assistance will be administered by the state UI programs. Therefore, you must apply with your state UI program. Please note that there have been record unemployment claims filed recently. Therefore, it is advised that you file quickly if you are eligible in order to avoid delays.

STIMULUS FOR BUSINESSES

Paycheck Protection Program (PPP) Loans

DETAILS:

Loans up to $10 million to businesses affected by the pandemic. Loan amount is capped at 2.5x the business’ average monthly payroll.

Interest rate is fixed at 0.5% on a 2-year term with no payments required for the first 6 months. Key benefits of these loans are that they do not require a personal guarantee, no collateral is required, and the loans can become forgivable if used for payroll (including benefits) and other eligible costs.

WHO IT APPLIES TO:

Loans are made available to businesses with under 500 employees and sole proprietors in operation as of February 15, 2020. Additionally, independent contractors and self-employed individuals may also qualify.

HOW DO I GET IT?

For small businesses and sole proprietors, applications can be submitted beginning April 3, 2020 with existing SBA lenders. For independent contractors and the self-employed, the application window opens April 10, 2020.

Loans up to $10 million to businesses affected by the pandemic. Loan amount is capped at 2.5x the business’ average monthly payroll.

Interest rate is fixed at 0.5% on a 2-year term with no payments required for the first 6 months. Key benefits of these loans are that they do not require a personal guarantee, no collateral is required, and the loans can become forgivable if used for payroll (including benefits) and other eligible costs.

WHO IT APPLIES TO:

Loans are made available to businesses with under 500 employees and sole proprietors in operation as of February 15, 2020. Additionally, independent contractors and self-employed individuals may also qualify.

HOW DO I GET IT?

For small businesses and sole proprietors, applications can be submitted beginning April 3, 2020 with existing SBA lenders. For independent contractors and the self-employed, the application window opens April 10, 2020.

Economic Injury Disaster Loan (EIDL)

DETAILS:

Loans up to $2 million to businesses affected by the pandemic. Interest rate is fixed at 3.75% on a term up to 30 years. Similar to the PPP loan, there are some restrictions on how the funds are used. However, unlike the PPP loan, none of the loan amount is eligible for forgiveness.

An emergency advance of $10,000 against the loan can be made within 3 days of the application per the legislation. However, it is uncertain as of today how this will be realized.

WHO IT APPLIES TO:

Requirements are similar to the PPP loan. You can view the requirements on the application website listed below.

HOW DO I GET IT?

You can apply for a COVID-19 related EIDL loan directly on the SBA website at the following link: https://covid19relief.sba.gov/#/

Loans up to $2 million to businesses affected by the pandemic. Interest rate is fixed at 3.75% on a term up to 30 years. Similar to the PPP loan, there are some restrictions on how the funds are used. However, unlike the PPP loan, none of the loan amount is eligible for forgiveness.

An emergency advance of $10,000 against the loan can be made within 3 days of the application per the legislation. However, it is uncertain as of today how this will be realized.

WHO IT APPLIES TO:

Requirements are similar to the PPP loan. You can view the requirements on the application website listed below.

HOW DO I GET IT?

You can apply for a COVID-19 related EIDL loan directly on the SBA website at the following link: https://covid19relief.sba.gov/#/

Employee Retention Tax Credit (ERTC)

DETAILS:

The amount of the credit is 50% of qualifying wages paid up to $10,000 in total. Wages paid after March 12, 2020, and before Jan. 1, 2021, are eligible for the credit. Wages taken into account are not limited to cash payments, but also include a portion of the cost of employer-provided health care.

For employers with less than 100 employees on average in 2019, the credit is based on all payments to employees, whether they worked or not. Otherwise, the credit is only allowed for employees that did not work during the calendar quarter.

WHO IT APPLIES TO:

The credit is available to all employers regardless of size with only two exceptions: State and local governments and small businesses who take small business loans. Qualifying employers must fall into one of two categories:

This credit will be addressed with your CPA when you file your 2020 taxes. Please note that the credit is not available for businesses taking small business loans that are outlined above.

The amount of the credit is 50% of qualifying wages paid up to $10,000 in total. Wages paid after March 12, 2020, and before Jan. 1, 2021, are eligible for the credit. Wages taken into account are not limited to cash payments, but also include a portion of the cost of employer-provided health care.

For employers with less than 100 employees on average in 2019, the credit is based on all payments to employees, whether they worked or not. Otherwise, the credit is only allowed for employees that did not work during the calendar quarter.

WHO IT APPLIES TO:

The credit is available to all employers regardless of size with only two exceptions: State and local governments and small businesses who take small business loans. Qualifying employers must fall into one of two categories:

- The employer's business is fully or partially suspended by government order due to COVID-19 during the calendar quarter.

- The employer's gross receipts are below 50% of the comparable quarter in 2019. Once the employer's gross receipts go above 80% of a comparable quarter in 2019, they no longer qualify after the end of that quarter.

This credit will be addressed with your CPA when you file your 2020 taxes. Please note that the credit is not available for businesses taking small business loans that are outlined above.

Tax Rules Changes Affecting Small Businesses

DETAILS:

Various businesses

HOW DO I GET IT?

These tax changes will be addressed with your CPA when filing income tax or payroll tax returns.

- Employers can delay the payment of a portion of their 2020 payroll taxes until 2021 & 2022.

- Net Operating Loss (NOL) rules established by the Tax Cuts and Jobs Act (TCJA) are modified. The 80% rule has been lifted and losses can now be carried back 5 years.

- Excess Loss Limitation (ELL) rules for pass-through entities are suspended.

- Interest expense limitations are increased to 50% from 30% for tax years beginning in 2019 or 2020.

- Businesses will be able to immediately write off costs associated with improving facilities instead of having to depreciate those improvements over the asset’s 39-year life.

Various businesses

HOW DO I GET IT?

These tax changes will be addressed with your CPA when filing income tax or payroll tax returns.